In the event of death or incapacity, estate planning is fundamentally a process for:

Below documents could be prepared when you take the Will and Trust Package.

Will is a Legal document which takes effect at the death, state requirement vary, each state will have different requirements.

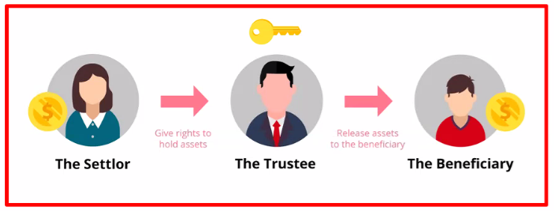

A living trust allows you to transfer your assets to loved ones quickly and easily. It’s “living” because it’s in effect while you’re alive, as opposed to a will, which only kicks into gear after you’re gone. You can put in things like bank or savings accounts, real estate, art, jewelry and even intellectual property in a living trust. However, even though those assets are named inside your trust, they're not accessible to others until after your death.

A revocable trust just means you can change the terms of the trust. Irrevocable? Yep, you guessed it. You can’t change the terms.

Revocable trusts magically transform into irrevocable trusts after your death.

Trust has No value without transffering properties or assets to the Trust!!

Power of Attorney for Health Care Decisions/HIPAA Authorization

Type of advance directive in which you name a surrogate to make healthcare decisions for you when you are unable to do so.

Advance Directive or Living Will

Written, legal document that guides the choices for doctors and caregivers (terminally ill, dementia, coma, near end of life)

Estate planning is the process of preparing for potential future events, such as death or incapacitation, by outlining how your assets and affairs will be managed and distributed. It involves creating legal documents like wills and trusts, and often includes planning for taxes, healthcare, and guardianship of minor children.

Key Aspects of Estate Planning:

Asset Management and Distribution: Estate planning ensures that your assets are managed and distributed according to your wishes after you pass away or become incapacitated.

Legal Documents: